Southeast Asia’s e-commerce is maturing and entering different phases of growth. Customers and merchants alike are transforming their behaviour and expectations. If you are a small merchant in the region, it is smart to partner with logistic solutions that can match your customer’s growing expectations.

On one hand, consumers are purchasing a broader range of products across multiple digital channels and expecting faster, more reliable delivery services. On the other hand, you are diversifying sourcing strategies, which requires more agile and capable logistics support.

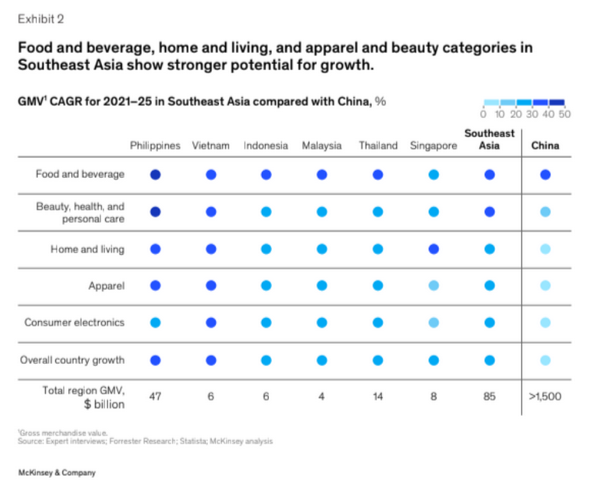

According to a McKinsey & Company study, the Southeast Asian markets could sustain robust double-digit annual growth of between 15 and 25 percent for the next five years.

Rising Demand for More Sophisticated Logistics Services

Customers in the region are becoming more comfortable with online shopping, to a point that it becomes part of their preference. If in the past couple of years, the majority of the purchases are apparel and consumer electronics – which traditional logistic solutions can easily meet — recently, the market is now shifting towards food and beverages, beauty products, and home goods.

This shift in product categories will necessitate new types of logistics services, as different products require different handling, storage, and transportation methods.

Moreover, customers in Southeast Asia will continue to adopt more digital channels for their shopping, creating a more complex and omnichannel retail environment. This shift is already visible in markets such as Vietnam, where social e-commerce platforms are gaining traction.

For example, TikTok Shop, which allows users to purchase products directly through live streams, is growing in popularity in Vietnam. These emerging channels present new opportunities for logistics providers to diversify their services and tap into new revenue streams.

Merchants Diversify Sourcing, Creating New Logistical Demands

A positive development for small to medium retailers is the availability of new supply chains – outside of China. In the past, merchants in the region relied heavily, if not solely on Chinese imports. However, as the market evolves, many merchants are favouring sources from regional neighbours like Vietnam, Thailand, and Indonesia. This trend is being driven by a desire to reduce supply chain risks, take advantage of lower costs, and tap into local manufacturing capabilities.

For logistics providers, this shift presents both challenges and opportunities. On one hand, managing a more diverse and regionalized supply chain requires greater complexity and agility.

On the other hand, logistics providers that can adapt to this new environment stand to benefit from increased demand for services such as cross-border fulfilment, warehousing, and transportation.

What Merchants Need to Know: Specialized Domestic B2C Logistical Features

As customers buy more products across online platforms and a wider range of categories such as food & beverage, beauty products, and home goods, logistics providers will need to offer specialised services tailored to different product types.

For example, the handling and delivery requirements for beauty products are vastly different from those for home furniture. Logistics companies that can adapt to these diverse needs by offering specialised services, such as temperature-controlled storage for perishables or white-glove delivery for high-end furniture, will be able to capture more value from the market.

Returns Management: A Critical Feature for any Product Category

Returns are an inevitable part of e-commerce, and they are particularly prevalent in Southeast Asia, where return rates for online purchases can reach 15 to 20 percent.

For merchants to thrive in this market, they need to select logistics providers that offers seamless and efficient return processes that enhance the customer experience.

In fact, a survey found that 83 percent of Southeast Asian consumers would increase their online purchases if they had access to a smooth returns process.

By 2026, the return logistics market in the region is expected to reach $21.9 billion, making it a significant growth area for logistics providers.

Bulky Product Handling: Meeting Growing Demand for Home Goods

As e-commerce penetration increases in categories such as homeware and furniture, merchants need to expect from their logistics providers the ability to handle large, bulky items.

Customers in countries like Indonesia, Thailand, and Vietnam are increasingly purchasing furniture online, but logistics providers often struggle to meet their expectations for reliable, affordable delivery.

Companies that can offer specialised services such as protective packaging, door-to-door delivery, and onsite assembly for bulky products will be well-positioned to capture a significant share of this growing market.

E-Groceries. Same-day, Rapid Delivery

Smaller merchants are now entering the e-grocery market in Southeast Asia, while it is still in its early stages, it is expected to grow rapidly in the coming years, reaching $25 billion by 2025.

E-grocery logistics present unique challenges for merchants, it requires the need for rapid, point-to-point delivery and specialised handling for perishable goods.

To succeed in this space, merchants must partner with those that have robust last-mile delivery capabilities and are investing in technologies that enable real-time tracking and efficient route optimization.

The Evolving Demand for Specialised Logistics in Southeast Asia

Merchants are often advised to stay ahead of rapidly shifting consumer preferences. Equally important is choosing the right logistics partners who can help them adapt and meet these evolving demands effectively.

As consumer demands evolve, so do the logistical solutions that not only bring products from point A to point B, but also include specialised features like easy returns, reliable and timely delivery, and special handling.

However, success will require bold investments in infrastructure, technology, and partnerships.

Merchants should be on the lookout for companies that can adapt quickly to the new realities of Southeast Asia’s e-commerce market and will be well-positioned to emerge as leaders in the region’s next phase of growth.