Influencer marketing has been making waves in Southeast Asia. Many brands believe it is a key aspect of their marketing strategy – but an important question remains – is it really an effective strategy for retailers in the region?

Many studies like the Citi-Cube Asia’s Profitable Pathways Research pointed out the need for eCommerce leaders to diversify their online channel mix to help improve their top-line revenue and profitability.

Fast-growing channels like TikTop Shops have gained popularity and credibility in the region. These non-Shopee or non-Lazada platforms are gaining attention among retailers as they have lower commission and logistic rates – something that smaller retailers crave these days.

TikTok Shops rely heavily on influencer marketing, which many businesses in the region are still trying to understand.

With these new strategies emerging and growing in significance, as a retailer in the region, what would be your best strategic moves? We’ll find out in this blog.

Digital Commerce Growth in Southeast Asia

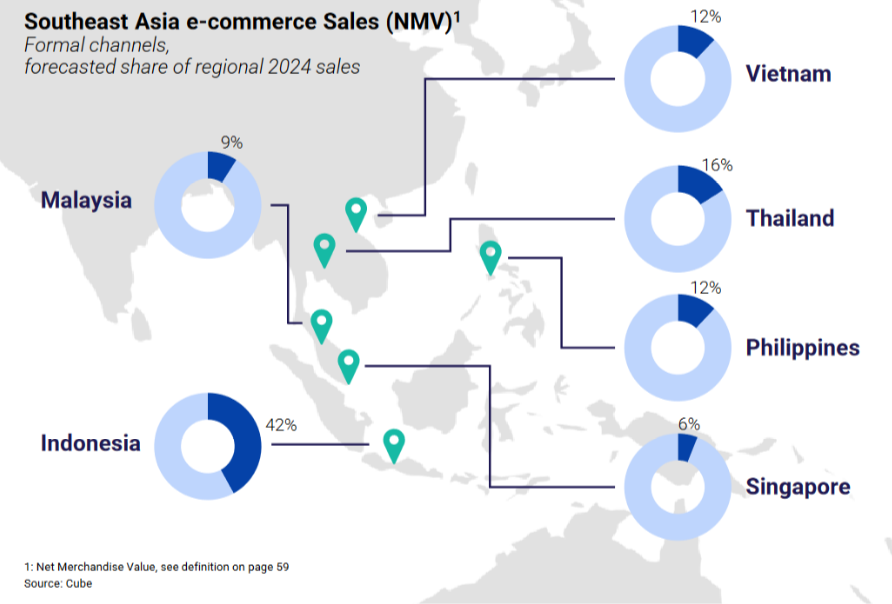

First, let’s understand how big eCommerce or digital commerce is in Southeast Asia.The formal e-commerce channels across Southeast Asia generated an impressive $127 billion in sales last year.

This figure is projected to rise steadily, reaching $305 billion by 2029. While the growth trajectory is stable, it is expected to taper slightly after the accelerated boom of recent years.

Southeast Asia’s e-commerce market is heavily concentrated in three major players: Indonesia, Thailand, and the Philippines. Together, they account for over 70% of the region’s e-commerce activity. Indonesia continues to be the largest market by sheer size, but it’s facing stiff competition from its neighbours.

In fact, Vietnam, Thailand, and the Philippines are expected to outpace Indonesia’s growth in the coming years. This highlights the dynamic nature of the Southeast Asian market, where countries once playing catch-up are now taking center stage in the digital economy.

Strategic Move: Utilising Influencer Marketing for Sales

Influencer marketing is a key driver of e-commerce sales in Southeast Asia. The growing influence of social media and, more specifically, influencer marketing is now taking center stage.

In 2024, influencer marketing is projected to directly contribute around $15 billion in Net Merchandise Value (NMV), highlighting its crucial role in driving online sales.

What’s particularly interesting is that an additional $31 billion is attributed to the indirect impact of influencers—through building brand awareness, influencing purchase decisions, and fostering customer loyalty. This combined direct and indirect contribution underscores the power of influencer-driven strategies in shaping consumer behaviour.

As more and more businesses realise the positive effect of influencers on sales, the investment on influencer marketing is on an upward trend. By the end of 2024, spending on influencer partnerships is expected to hit $5 billion.

This surge in investment shows that brands are doubling down on influencers, recognizing them as vital assets in a competitive e-commerce environment.

Next Strategic Move: Selecting Platforms and Influencers that Matter Most

While it’s becoming clearer that influencer marketing is an effective sales mechanism, another lingering question on retailers’ minds is: Which platforms and influencers matter most?

According to the Cube and Impact.com study, YouTube, Facebook, and TikTok are the best platforms for influencer marketing.

A.) YouTube, Facebook, and TikTok are the Dominant Platforms.

YouTube, in particular, has seen the highest increase in adoption, with a 2% growth in the past year. Despite TikTok’s growing popularity, its usage in Indonesia saw a 9% decline following the ban of TikTok Shop in 2023—a reminder of how integral e-commerce features have become to these platforms.

Most Southeast Asian consumers aren’t platform-loyal; they use an average of four different platforms, with YouTube, Facebook, and TikTok leading the pack. This multi-platform approach gives brands a broader reach, but also makes it essential to tailor content to each platform’s unique audience.

B.) YouTube: The Top Influencer Platform

When it comes to influencer-driven content, YouTube stands out as the most effective platform. About 40% of user time on YouTube is spent consuming influencer or celebrity content, which is double the time spent on Facebook. YouTube, TikTok, and X (formerly Twitter) are the top platforms for influencer engagement, capturing a significant share of user attention.

Influencer content ranks as the second most popular type of content consumed on these platforms, making it an essential tool for brands looking to boost their visibility and sales.

C.) Diverse Influencers, Diverse Content

One trend that continues to grow in Southeast Asia is the diversity of content and influencers that consumers follow. Shoppers are no longer looking to just one source for inspiration; instead, they’re turning to a variety of influencers across different platforms and content types. In fact, ‘finding inspiration for things to buy’ has become one of the fastest-growing reasons for engaging with influencer content since 2023.

D.) Top Categories: Beauty, Fashion, and Groceries

In terms of sectors, beauty, fashion, and groceries are leading the way when it comes to influencer-driven sales. These categories have seen the highest growth in influencer shopping, driven by product recommendations and curated shopping experiences.

E.) Mega vs. Nano Influencers: Who Do Consumers Trust?

When it comes to trust, mega influencers hold the upper hand. They tend to have the strongest impact on purchase decisions, even more so than celebrities. However, there’s an interesting trend to watch: nano influencers are on the rise.

These smaller influencers, often with niche audiences, have seen a 3% increase in trust and are playing an increasingly important role in driving e-commerce purchases.

What’s Next for Southeast Asia’s E-Commerce Market?

Southeast Asia’s e-commerce market is growing at a remarkable pace, with influencer marketing playing a pivotal role in this expansion.

As small to medium retailers look to carve out their space in this competitive landscape, investing in influencer partnerships and leveraging the region’s most popular platforms—YouTube, Facebook, and TikTok—will be key to driving future growth.

The market may be maturing, but the opportunities for retailers to connect with consumers through innovative strategies are just beginning to take shape.